By Riley Robinson, news staff

Alex Ahmed, a fourth-year Ph.D. student in personal health informatics, lives with three other people in an apartment in Jamaica Plain. Like other graduate students who work as teaching or research assistants, she receives a tuition waiver and lives off a stipend provided by the university.

“I would definitely say it’s challenging. I know a lot of students take second jobs to make it work,” she said. “I took a second job to make it work.”

Ahmed and many other Northeastern graduate students have expressed concern about H.R. 1, the Republican tax reform bill in the House of Representatives. Some changes would directly affect college students, such as cutting the deduction for interest on student loans. It would also count tuition waivers like Ahmed’s as taxable income, bumping these students into tax brackets more than double the rate they would be paying otherwise.

Professor William Dickens, chair of the Department of Economics, said it is unprecedented for a bill with such large effects on the American economy to be pushed through Congress with the speed of this tax reform.

“The Republican party is pushing this bill through quickly,” Dickens said. “The only possible explanation for why they are pushing it through so quickly is they know it’s a bad bill and they want it to pass before there’s public pushback against it.”

Dickens also said that graduate students’ worries are justified.

“Anyone who’s thinking about going to graduate school in a field where they’re likely to get an assistantship or a fellowship should be aware of the fact that this is going to make it really, really hard for them to survive,” he said.

Dickens said graduate students could face a 50 percent increase in taxes, something Ahmed had already discovered in her own estimates.

“I would be paying almost half my income as taxes,” Ahmed said. “My other half is already on rent. If I didn’t have a second job, I would have zero left over for living.”

The reality may be even worse than what Ahmed predicts. If House tax reform became law, Ahmed would likely be paying more than half of her stipend in federal taxes.

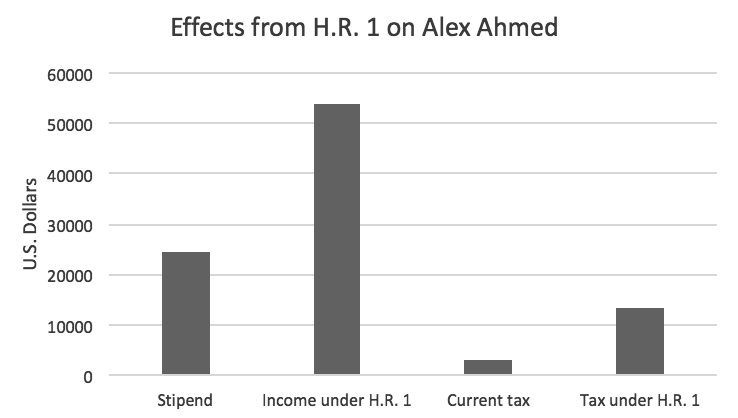

Ahmed received $24,640 as stipend from the College of Computer Science this school year, according to billing invoices she shared with The News. Under the current tax code, she is in the 15 percent bracket and will owe $3,229.75 in federal taxes without any deductions.

Ahmed, like other graduate students, receives a tuition waiver from the university. It is essentially a scholarship — she never sees the money, it just states that she owes nothing on her student account. This year, her tuition is valued at $29,408.

Under the proposals in House tax bill, Ahmed’s income would now include the tuition she is not paying, for a total of $54,048. This amount puts her in a 25 percent tax bracket. Ahmed would then owe $13,512 in federal taxes. Massachusetts state income tax would take an additional 5.1 percent, which would no longer be deductible.

Ahmed would now have to live on less than $11,000 for the year. This is more than $1,000 below the federal poverty line. Poverty defined at the federal level would hit even harder in Boston, where the cost of living is higher. Boston housing costs are 24 percent greater than the national average and electricity costs are 57 percent higher according to a Boston Magazine analysis of U.S. Bureau of Labor Statistics data.

These increases would not only affect graduate students working as research or teaching assistants for the university, but also students whose tuition is paid for by an outside employer.

Northeastern is currently lobbying Congress to reject these changes, according to an email sent to all graduate students Nov. 17.

“Over the past several weeks the Northeastern Government Relations team has been on Capitol Hill urging members of Congress to oppose this bill,” Provost James C. Bean said in the email. “Our Government Relations team consistently pursues a proactive agenda on Capitol Hill on the behalf of the university including our students on efforts such as this tax reform bill, the travel ban and immigration, DACA, national financial aid policies and research funding.”

However, some students, especially those going on co-op, may potentially benefit from the proposed changes to tax bracket rates.

The Northeastern Visitor Center advertises the average co-op wage as $20 per hour. If a student were to work at this wage full-time for six months, they would earn $19,200. Under the current tax code, they would owe $2,413, but under the House bill, they would owe $109 less. Under the Senate’s proposal, their taxes would be reduced by $300. These figures ignore any deductions or state income taxes.

The Senate version of the bill, titled the Tax Cuts and Jobs Act, does not cut the student-friendly deductions like its House counterpart. Graduate tuition waivers would not be taxed. The current $2,500 deduction for student loan interest would remain untouched.

First-year master’s of business administration student Chris Crouse said the current House bill would hurt graduate students in the short term, but is optimistic that university policies would adjust to offset the cost.

“The universities are going to bear the cost over the long term to compensate for the additional tax,” Crouse said. “Universities are going to have to stay competitive to get the best candidates, the best students. To do that, they’re going to have to up the stipend to offset the tax costs.”

Isha Srivastava is a second-year computer science graduate student and vice president of Graduate Student Government, or GSG. She said several students have expressed concern about the bill.

“Especially for people who are parents, for them it becomes very difficult if [a bill] like this is passed,” Srivastava said. “Even many of the master’s students are parents and are receiving income from the university. They are all going to be affected.”

GSG is currently planning a phone bank to call members of Congress and express their concerns.

“I hope it’s not passed,” Srivastava said. “I hope, for their betterment at least, that it doesn’t happen.”