Northeastern treasurer presents to Faculty Senate, discusses $1.3B university revenue

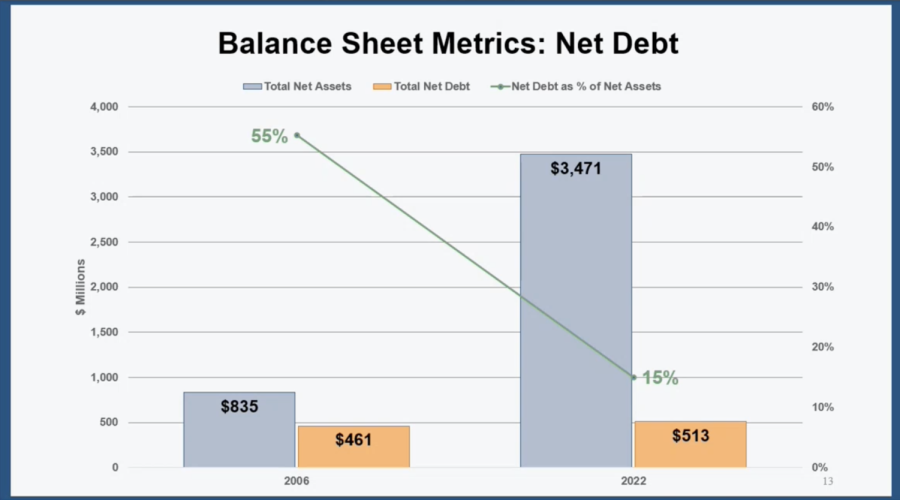

Northeastern’s net assets have risen dramatically since 2006, while debts have remained relatively stable, according to Nedell. Total revenue has increased by 7.8% in this time. Photo courtesy of the Northeastern Office of Finance.

November 22, 2022

The university’s faculty senate held its biweekly meeting Nov. 16, with Senior Vice President for Finance and Treasurer Thomas Nedell delivering an annual report to the body of senators from Northeastern’s academic colleges.

Prior to the report, Provost and Senior Vice President for Academic Affairs David Madigan gave an update on faculty searches across the university.

“There may well be hundreds of search committees,” Madigan said. “It is immensely important to the future of our institution.”

Searches continue for deans for the D’Amore McKim School of Business, the College of Social Sciences and Humanities and the Bouvé School of Nursing, as well as chairs for the communication sciences and disorders, physical therapy and bioengineering departments.

Afterwards, the senate voted on several academic proposals for undergraduate and graduate degrees.

The first program that passed was a Bachelor of Science in digital transformation, a degree that will be delivered entirely online, Vice Provost of Curriculum and Programs Mike Jackson said.

In addition, four academic proposals for graduate programs were passed relating to educational programs.

“As a part of the merger process with Mills College, the university wanted to recognize the legacy of teacher preparation that Mills had enjoyed for a long time,” Jackson said. “These four programs are teacher credential programs that are directed to respect that legacy but also take it into the future with Northeastern, with a focus on more direct experiential learning as a part of that process.”

The senate passed proposals for Masters of Arts in early childhood education, educational leadership, multiple subject education and single subject education. These programs will also enable students to apply for teacher licensure before graduation.

Carey Rappaport, a distinguished professor of electrical and computer engineering, asked how the acquisition of Mills College affected Northeastern’s balance sheet.

The answer, Nedell said, is that some of these numbers will be affected by the university’s acquisition of Mills College in the coming fiscal year because the deal was effective June 30.

“The transaction of that merger takes the value of Mills balance sheets marked up to current market value and [puts] it on to our balance sheets,” Nedell said. “We took on their assets, their endowment of just a bit under $200 million, their land and buildings … at about $550 million.”

“Our financial position at the university continues to strengthen,” Nedell said. “It does that through growth and diversification anchored in academic excellence.”

Northeastern’s revenue growth, Nedell said, exceeds average growth in the private university sector, with Northeastern’s revenue increasing by 7.8% since 2006, a full three points higher than the sector average.

“The university’s total assets are $5.5 billion as of June 30, 2022,” Nedell said. “Our total revenue … for this past year was $1.8 billion.”

This number of total assets is constituted, in part, by $3.4 billion in total net assets and approximately $1 billion in long-term debt.

“The university has very consciously taken out debt to do things like build out all of West Village student housing,” Nedell said. “Making strategic investments at the right time has huge dividends for our successors.”

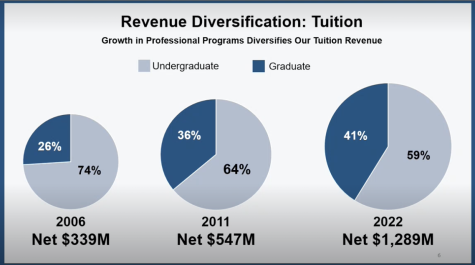

Northeastern’s revenue diversification, Nedell continued, is also increasing.

“Back in 2006 we were very concentrated within the undergraduate line of our offerings,” Nedell said. “That has morphed over time so that the graduate programs are growing at a much larger percentage over that time.”

Net tuition at Northeastern, after accounting for financial aid, sits at approximately $1.3 billion, with 59% of revenue coming from undergraduate programs. In 2006, net tuition was $339 million, with 74% coming from undergraduate programs. The graduate/professional revenue has grown 11% from 2011 to $531 million.

This growth is apparent in other areas as well, with research awards growing 10% from 2006 to $232 million in 2022, up $50 million just from 2021. Philanthropy has also seen 10% average growth, with $99 million in philanthropic donations.

Ganesh Krishnamoorthy, a professor of accounting, asked about the rate of return for the endowment fund.

“The university compares quite favorably to both a peer set of schools as well as a broader universe,” Nedell said. “2022 was a down year, -6.8% for endowment return, but we fared favorably compared to those other groups.”

Despite the size of the endowment at $1.6 billion, the university is not at all “dependent to any material amount” on the endowment to contribute to its revenue, Nedell said.

Paul Chiou, an associate teaching professor of finance, asked if the increase in revenue is due to an ability to charge higher tuition, inflation or an increase in student enrollment.

“We have, yes, increased the price side of tuition revenue in the 3.5 to 4.9% [range],” Nedell said. “The volume is driving that average growth rate … the volume is our position in the market being able to attract students.”

In response to another question from Chiou about diversifying tuition in terms of student population and enrollment, Nedell gave two separate answers.

“If we could serve them, we could let in twice as many undergraduate students that are roughly of the same caliber,” Nedell said. “We just don’t have the facilities to be able to serve that many more undergraduate students.”

For the graduate population, however, Nedell had a slightly different answer.

“I would project, over time, that we will see our undergraduate population staying roughly steady … while the graduate category continues to grow,” Nedell said. “China and India far dominate the composition of our master’s students, and we need to be realistic about diversifying where those students come from so that we’re not caught in a geopolitical squeeze that hampers our ability to attract and serve students.”

Valerio Toledano Laredo, a professor of mathematics, asked Nedell about the status of a past Senate resolution from 2021 asking the university to divest from fossil fuels within two years.

Nedell explained that the university has instead adopted an investment strategy to have an impact on climate change.

“The university has not adopted a divestment strategy,” Nedell said. “We allocated $25 million … to very targeted investments that would be part of a solution, rather than running away from Exxon with our small slice of whatever we have in the endowment, to have further impact.”

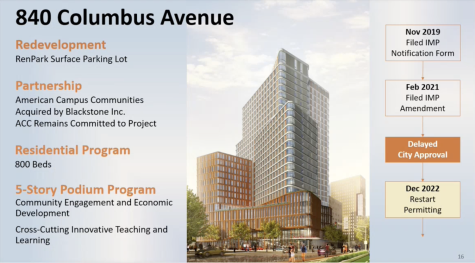

Nedell closed out his report with updates on two large capital expenditures: EXP and housing at 840 Columbus Ave.

840 Columbus Ave, which will hold 800 student beds and five stories of academic space when opened, is restarting its permitting process after delays with the city.

“[The project’s been] tied up in city politics and the transition to a new mayoral administration, [and] there’s been a general slowdown of new projects getting approved,” Nedell said. “[There’s] still a long way to go before [we] actually [get a] shovel in the ground.”

EXP will be 350,000 square feet of research and classroom space opening in August 2023 and, budgeted at $400 million, is one of the major ongoing investments that the university has.

“Without the financial resources, we can’t pursue our aspirations, we can’t have the impact that our academic plan lays out,” Nedell said “We are using margins that the university generates to reinvest into the capital and the people that are needed to build this institution.”